How to start working as a Payroll Coordinator?

Payroll Coordinators don't often need specialized degrees, but people who have previous experience at any type of payroll company or have worked as Production Accountants or on productions in general are very much in demand. Payroll Coordinator are so familiar with Union agreements that it becomes a second language.

They also must know every state's individual payment requirements, a skill that should also come in handy. To start working as a Payroll Coordinator, you can follow these general steps:

Apply for Payroll Positions

Look for job openings or vacancies for payroll positions in companies, organizations, or industries where your skills and interests align. Tailor your resume and cover letter to highlight your relevant experience, skills, and certifications. Emphasize your attention to detail, knowledge of payroll processes, and compliance expertise.

Develop Organizational and Detail-oriented Skills

Payroll Coordinators need strong organizational and detail-oriented skills to manage complex payroll processes effectively. Focus on developing skills in data management, record-keeping, time management, and attention to detail.

Gain Knowledge and Skills

Familiarize yourself with payroll processes, tax regulations, labor laws, and industry-specific requirements. Consider enrolling in courses or obtaining certifications in payroll management or accounting to enhance your knowledge and credentials.

Gain Experience

Seek opportunities to gain practical experience in payroll processing. Look for internships, entry-level positions, or roles in payroll departments where you can learn about payroll systems, calculations, and compliance.

Familiarize Yourself with Payroll Software

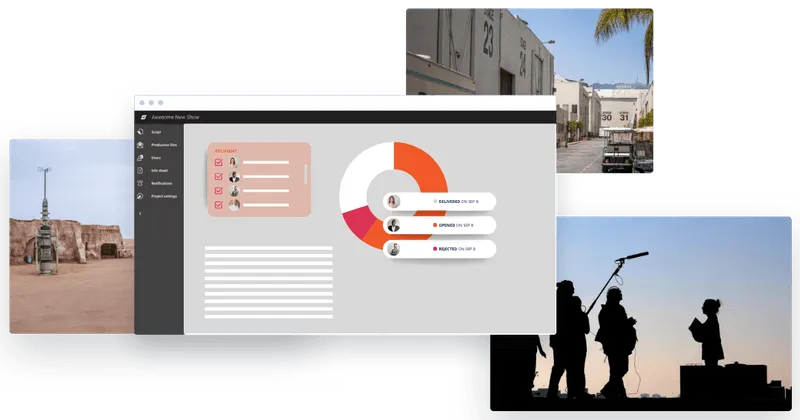

Many organizations utilize specialized payroll software to streamline payroll processes. Familiarize yourself with popular payroll software platforms of payroll companies like Revolution and learn how to navigate and operate them effectively.

Prepare for Interviews

Be prepared for interviews by researching the company, practicing common interview questions, and showcasing your understanding of payroll regulations, attention to detail, and problem-solving skills. Be ready to provide examples of your experience and how you have handled challenging payroll situations.

Stay Updated on Industry Regulations

Payroll regulations and labor laws can change, so it's essential to stay updated. Subscribe to relevant newsletters, follow industry publications, and participate in professional associations or forums to stay informed about the latest payroll regulations and best practices.

Build a Professional Network

Networking can provide opportunities for career advancement and professional growth. Attend industry events, join professional associations, and connect with other payroll professionals. Building a network can help you access job opportunities, gain insights, and learn from experienced Payroll Coordinators.

Obtain Professional Certifications

Consider pursuing professional certifications in payroll management or related areas to enhance your credibility and marketability. Certifications such as Certified Payroll Professional (CPP) or Fundamental Payroll Certification (FPC) can demonstrate your expertise and commitment to the field.

Continuously Learn and Improve

Payroll processes and regulations evolve, so it's important to remain committed to learning and professional development. Stay informed about industry updates, attend relevant training sessions, and seek opportunities to enhance your skills and knowledge in payroll management.

Starting as a Payroll Coordinator may involve entry-level positions or working under the guidance of an experienced Payroll Coordinator to gain experience and demonstrate your skills, you can pursue opportunities for growth and advancement in the payroll field.